AOLTV Tries to Leverage Online Audience into Hybrid Convergence, Battling Microsoft

Digital Broadcasting.com's newest columnist asks: Will AOLTV succeed where WebTV didn't?

The launch of AOLTV this month marks the next step in America Online's battle with Microsoft, and it comes as an ersatz digital TV faceoff in the far-flung venues of Sacramento, Phoenix, Baltimore and five similar markets. America Online hopes that this Internet-on-TV access service will stimulate more interest than Microsoft's rival WebTV service, which is itself in the process of being transmogrified into Microsoft UltimateTV.

The launch of AOLTV this month marks the next step in America Online's battle with Microsoft, and it comes as an ersatz digital TV faceoff in the far-flung venues of Sacramento, Phoenix, Baltimore and five similar markets. America Online hopes that this Internet-on-TV access service will stimulate more interest than Microsoft's rival WebTV service, which is itself in the process of being transmogrified into Microsoft UltimateTV.

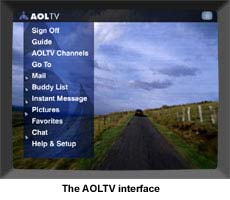

AOLTV, part of the emerging "AOL Anywhere" assault, allows customers to access the conventional AOL online service through a $249 Philips set-top box attached to a TV set and phone line. The built-in 56 kilobit per second modem gives this stand-alone box the same functionality as WebTV – or for that matter, the British Prestel service circa 1980 (albeit at higher speed). Subscribers, who pay an extra $14.95 per month if they are already AOL customers or $24.95 per month if they are not, can surf the AOL service and the Internet, handle e-mail and conduct other Web activities through the AOLTV device.

For AOL, as for Microsoft, the real payoff is in the integration of television programming with the online features to create, voilà, interactive TV. Enhancements such as sports statistics, on-screen program guides, simultaneous chat lines, production notes and similar elements can be displayed at the viewer's command.

Not to mention "T-commerce". Television commerce, the ability to buy products that actors are wearing or using during a show or click-and-buy during commercials, is the next nirvana in this video-centric arena. AOL, with its growing reliance on e-commerce, would love to exploit that opportunity on the living room TV screen.

Following the same route that WebTV traveled a year ago, AOLTV is recruiting program networks to prepare specialized online content intended to coincide with video shows. Starz Encore network has signed on, with the objective of creating some video-on-demand services. QVC and Court TV also plan to develop specialized segments.

That's a far cry from the 30 networks that WebTV has signed up, although most of them offer very limited enhancements.

Initially, Philips is the only supplier of the AOLTV box, which will be available at Circuit City and through an online store. Philips was also the first (along with Sony) to build WebTV boxes nearly four years ago. Look for extensive promotions via AOL in the eight initial markets this summer, then nationwide as the wide rollout begins in autumn.

All of this makes AOLTV look like a tardy also-ran in a market that has never taken off. WebTV has signed up a measly 1.1 million customers during the past three years, and has had almost no growth since last Christmas despite the enhanced TV program features. Half the subscribers use the low-end WebTV "classic" version, which does not support the integrated television functionality. WebTV officials admitted to me that there may be a small marketing binge this autumn to unload the final inventory of equipment, but that the company is moving on toward its new UltimateTV service, which is built on the Microsoft Digital TV platform. In that regard, Microsoft will leverage its relationship with EchoStar. The two companies support the Dishplayer 500 receiver – a box that offers integrated WebTV content along with a hard drive that makes the set-top into a Personal Video Recorder (PVR).

Indeed, that is the objective of AOLTV, too. AOL has set up a relationship with TiVO, a pioneering PVR company, and TiVO already has an alliance with DirecTV. Thanks to its $1.5 billion investment in DirecTV, AOL is poised to integrate its online enhancements into a multipurpose digital TV service next year. A combination AOLTV + DirecTV TiVO receiver will go on sale in early 2001. Prices will probably be under $500.

To define the competing camps even more distinctly: AOLTV is built on the software platform created by Liberate Technologies, which itself is a spinoff from Oracle Corp. – the sworn blood enemy of Microsoft.

So the stage is set for a feature battle and supremacy war between the AOL-DirecTV-TiVO camp vs. the Microsoft-EchoStar camp, in a satellite skirmish that will soon weave its way into the cable TV market as well. AOL's takeover of Time Warner (which provides cable system carriage plus the mighty HBO and Turner program resources) puts AOL head-to-head versus the Microsoft collection of media holdings, such as the $5 billion stake in cable behemoth AT&T.

Indeed, that's where the real action will begin. AOL officials admit that the current AOLTV rollout is a positioning process, to establish the company in the interactive TV space: a segment that may take off when digital TV becomes more widespread. AOL wants to exploit its customer base. It knows that more than 20% of its current subscribers are watching TV while using Instant Messaging or chat. The first campaigns for AOLTV will be aimed at those "habitual members," as AOL calls them.

To some skeptical observers, AOLTV is a non-issue, especially given the relative paucity of consumer interest in WebTV. Much of the trade press coverage of the AOLTV's preliminary announcements was relegated to back pages, sprinkled heavily with critical comments from analysts. But the attention being paid to it, even through negative comments, was envied by the president of another interactive TV company. She confessed to me that she'd like to get that kind of attention for any premature announcement.

Whichever way you examine it, AOLTV will become a centerpiece of the interactive TV arena during the coming year. Whether it's seen as a corporate faceoff with Microsoft or a test of AOL's ability to migrate from the online to broadband playing fields, the ultimate test of AOLTV is audience acceptance. That will depend on the quality of programming and services, not to mention the pricing and reliability, which this convergence hybrid actually delivers.

Gary Arlen is president of Arlen Communications Inc., a Bethesda, Maryland, research firm that specializes in interactive media services. He can be reached at GaryArlen@aol.com. (Back to top)

Gary Arlen is president of Arlen Communications Inc., a Bethesda, Maryland, research firm that specializes in interactive media services. He can be reached at GaryArlen@aol.com. (Back to top)